Learn how to support girls’ education in smart, tax-savvy ways

By Sonja Bahr

Central Asia Institute depends on the commitment and generosity of supporters like you to unlock the potential of girls and women through education. Many of our supporters want to ensure future generations of children in Central Asia receive the gift of education but aren’t sure how to go about it.

Here are just a few of the ways your commitment today can provide hope and opportunity for current and future generations, while also providing benefits such as tax deductions and regular income for life for you and your family.

Appreciated stock

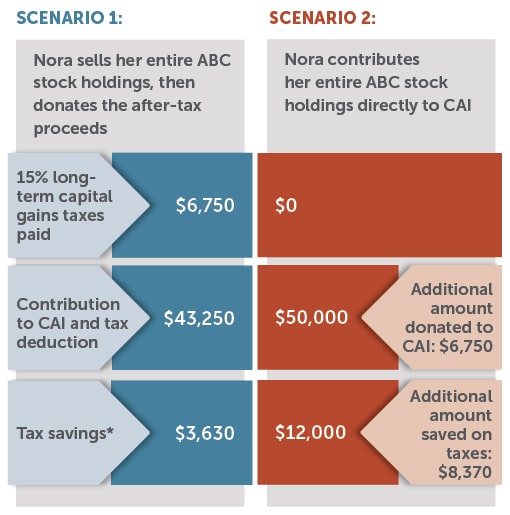

Donating appreciated stock is an excellent option for donors who would like CAI to benefit from gains made in the stock market while reducing their tax liability. A donation of stock is an easy transaction, and donating appreciated stock held at least one year typically avoids capital gains tax for the donor.

Here’s a scenario that demonstrates this: Nora purchased 1,000 shares of ABC 10 years ago at $5 per share. ABC stock is now valued at $50 per share, making Nora’s holdings valued at $50,000. If Nora donates the stock directly to CAI, three things happen: she can deduct her gift from her taxes; she can avoid paying capital gains tax on the $45,000 earnings on the stock; and she is able to increase the size of her gift to CAI while lowering her overall tax bill.

Qualified charitable distribution

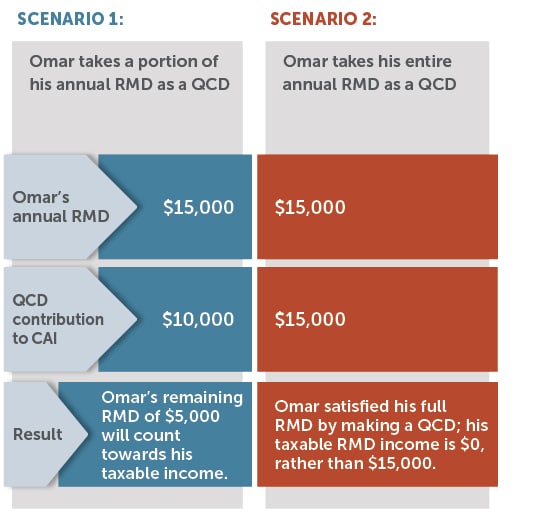

Donating to CAI using a qualified charitable distribution (QCD) is another tax-savvy way to support CAI. If you are 70½ years of age or older, you can make a tax-free transfer directly to CAI from your retirement account (such as an IRA or 401(k)) that will count toward your required minimum distribution (RMD).

For example, Omar’s annual RMD is $15,000. If Omar makes his donation to CAI using a QCD, his taxable RMD income is reduced or eliminated.

Charitable gift annuity

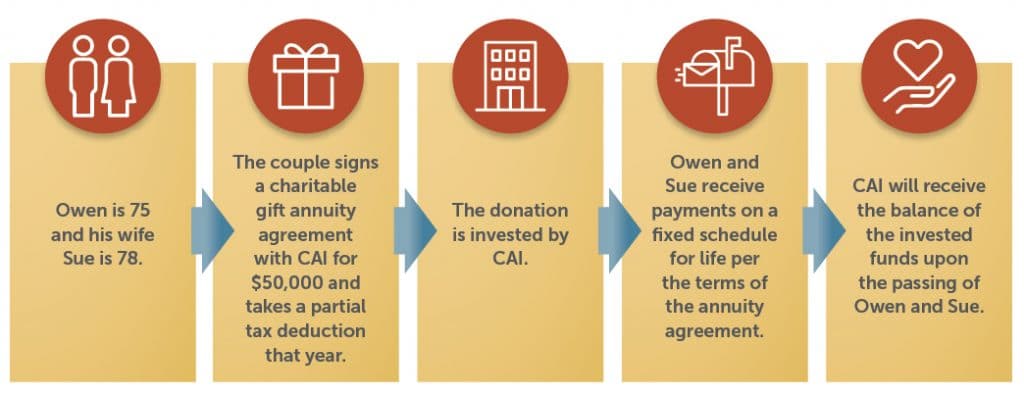

Establishing a charitable gift annuity will enable you to support CAI and feel confident that you have dependable income in your retirement years. This type of donation can provide you with regular payments for life, a portion of which may be tax-free.

Charitable bequest

A charitable bequest is a meaningful way to plan a gift that shapes your legacy and allows you to maintain control of your assets while reducing estate taxes. The lives of thousands of people in Afghanistan, Pakistan, and Tajikistan have been changed by individuals who thoughtfully included CAI in their estate plans. A few of the ways you can leave a bequest to Central Asia Institute include naming CAI in your will or trust, or designating CAI as a full, partial, or contingent beneficiary of your retirement account, pension, or life insurance policy.

If you have already made arrangements to give a gift to Central Asia Institute by placing us in your will or trust, or through a beneficiary designation, please take a moment to let us know. By sharing your intention with us, you can work with our team to ensure your gift will be used to meet your philanthropic goals and directed to those programs that are most important to you. We would also welcome the opportunity to express to you our gratitude and provide regular and timely updates on the lives you are touching in Central Asia.

Please contact us for more information about how to support our mission in tax-wise ways. We would be honored to help!

Sonja Bahr, Senior Development Officer

sbahr@centralasiainstitute.org

406.585.7841

*All of the examples above are hypothetical and for explanatory purposes only. These illustrations are not professional tax or legal advice. Please always consult a tax advisor about your specific situation to find the best solution to meet your needs.