Giving to CAI through your IRA is as easy as 123

By Sonja Bahr

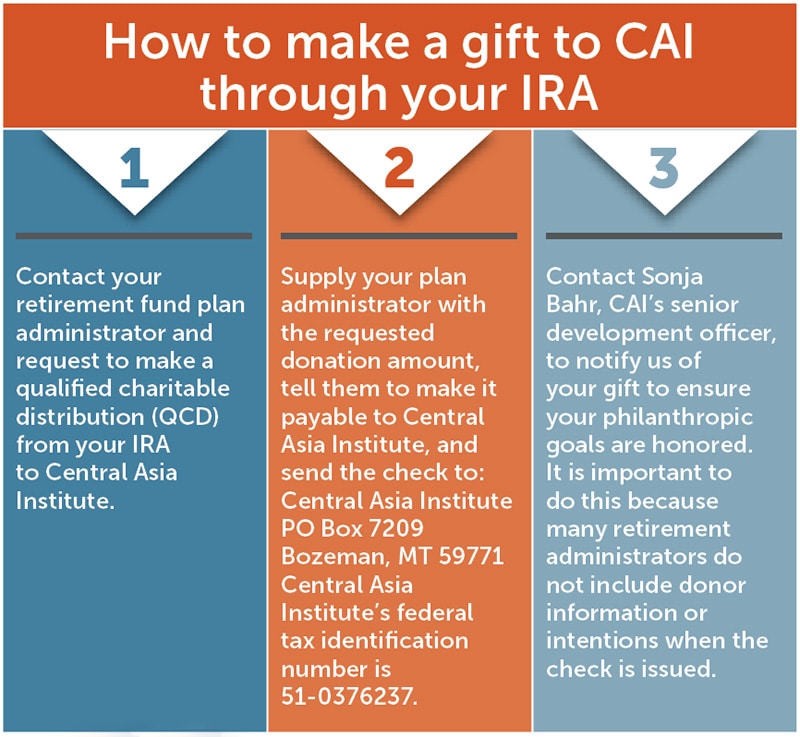

Trying to understand philanthropic giving, retirement fund requirements, and tax deductions can feel overwhelming. But making a donation to Central Asia Institute through your individual retirement account (IRA) is easy, can save you money on taxes, and, most importantly, will help provide education for girls and women living in the regions we serve.

Why consider making a donation through your IRA?

- If you are 70½ years of age or older, you can make a tax-free transfer directly to CAI from your IRA. Starting in the year you turn 72, you can use this gift to fulfill all or part of your required minimum distributions (RMDs).

- When the transfer is made directly from your IRA to CAI, you are not required to pay income taxes on the funds, even if you do not itemize your deductions.

Frequently Used Terms Cheat Sheet

Individual retirement account (IRA)

An account set up at a financial institution that allows individuals to save for retirement with tax-free growth or on a tax-deferred basis.

Qualified charitable distribution (QCD)

An otherwise taxable distribution from an IRA owned by an individual who is age 70½ or older that is paid directly from the IRA to a qualified charity.

Required minimum distribution (RMD)

The smallest amount you are required to withdraw from your tax-deferred retirement accounts every year after a certain age.

“Contributing to CAI from my IRA account was easy. It is a total win/win way to donate. The withdrawal of funds satisfies all or part of my required minimum distribution, and it is not reported as taxable income for me. I love it when things are easy, I accomplish something worthwhile, and it’s nontaxable. What could be better than that?”

– Claire, CAI donor for nine years

Growing up, Barbara’s parents encouraged her to be frugal with her money. But when her mom stepped in to support an impoverished family in Colombia who she had never met, Barbara learned another important lesson. Each week, her mother sent money for the family to buy food, and Barbara went from feeling overwhelmed by heartbreaking poverty to witnessing how one person—her mother—was making a profound difference in the lives of others. Barbara carried that lesson with her all her life, and after learning about CAI’s mission, felt as though she had found a way to give back as an adult.

“CAI’s efforts make a difference in the lives of people who I will never meet. … I feel grateful to know my economic privilege can be such a powerful tool for good. My parents taught me to be careful with my money, and I have a secure retirement. So when I needed to start taking the required minimum distribution from my IRA, I was dismayed to learn that it would likely push us into a different tax bracket. Fortunately, if I give that money away directly through my IRA, I don’t have any negative tax consequences. At tax time, I report the RMD and that it was a qualified charitable distribution. Go ahead. Use your retirement account to make the world a better place. Your mom will be proud.”

-Barbara, CAI donor for 11 years

Frequently asked questions

Q: Can I just take the funds from the IRA myself and then donate that amount to CAI?

A: How you process a QCD is very important if you want to benefit from the tax savings. If you withdraw money from your IRA yourself, or receive your RMD directly and then make a donation to CAI, the QCD will be disallowed. Funds must go directly from your IRA to the charity of your choice to qualify as a QCD.

Q: How much can I give each year from my IRA?

A: Individuals 70½ years of age or older can make QCDs up to the annual limit of $100,000. This limit applies to the total distributions within a calendar year, regardless of whether the distributions are made at the same time or to one or multiple nonprofit organizations.

Q: My spouse and I would like to give more than $100,000. Can we do that?

A: If you have a spouse (as defined by the IRS) who is 70½ or older, they can also give any amount up to $100,000 from their IRA.

Q: I have more questions or would just like to talk this through. Who should I contact?

A: We are honored to help you reach your philanthropic goals and are here to answer your questions!

For more information, please contact Sonja Bahr, senior development officer, at 406.585.7841 or sbahr@centralasiainstitute.org.